Leading with

Absolute Value., Performance., Experience., Extensive Research., Capital Protection., Favourable Returns., Bespoke Solutions.

Rakshat Kapoor

Chief Investment Officer

Striving towards absolute value, since inception.

Founded in 2018, Modulus Alternatives has established a successful track record of investing in private credit opportunities. With an emphasis on capital protection and dynamic fund management that include active portfolio monitoring, the firm aims to continue delivering absolute value to its investors.

Figures as on October 07, 2024

Figures as on September 30, 2023

Leading with Corporate Governance

Vinod Rai

Chairman of the Board

Modulus Alternatives Investment Managers Limited

Our Private Credit Funds:

Fund 1

Centrum Credit Opportunities Fund (CCOF)

We launched our first private credit fund, Centrum Credit Opportunities Fund, in 2019 and have successfully completed 5 years of the investment period with 15 investments across sectors. CCOF is tracking mid-teen returns since inception with consistent quarterly distribution to investors.

- ₹1,790 cr Invested Capital - across AIF & Other Investors

- ₹1,570+ cr Cumulative capital returned to investors

- 16%+ Tracking a Gross Fund IRR

- 15 Investments

- 15 Exits

Figures as on October 07, 2024

- ₹1,250 cr Target fund size#

- 05 Years fund tenor*

- 16%+ Target yield – gross fund IRR

#₹750 cr + ₹500 cr green shoe option

*From final close

#₹750 cr + ₹500 cr green shoe option

*From final close

Fund 2

India Credit Opportunities Fund II (ICOF II)

- Healthcare

- Consumer

- Industrials

- Specialty Chemicals

- Logistics

Assisted by Best in Class

Service Partners

Statutory Auditor

Legal Counsel

Tax Advisory

RTA & Investor Relations

Tax Advisory

Statutory Auditor

Legal Counsel

Statutory Auditor

Legal Counsel

Tax Advisory

RTA & Investor Relations

Tax Advisory

Statutory Auditor

Legal Counsel

Tax Advisory

Collaborating for success through

our Investment Portfolio

Success is a shared journey which originates from our vision

to create value together.

BFSI

Chemicals

Fertilizers

BFSI

Consumer Durables

Infrastructure

Pharmaceutical

Steel

Fertilizers

Infrastructure

Warehousing

Power

Power Transmission

Pharmaceutical

Auto Ancillary

Auto Ancillary

Energy

BFSI

Chemicals

Fertilizers

BFSI

Consumer Durables

Infrastructure

Pharmaceutical

Steel

Fertilizers

Infrastructure

Warehousing

Power

Power Transmission

Pharmaceutical

Auto Ancillary

Auto Ancillary

Energy

Infrastructure

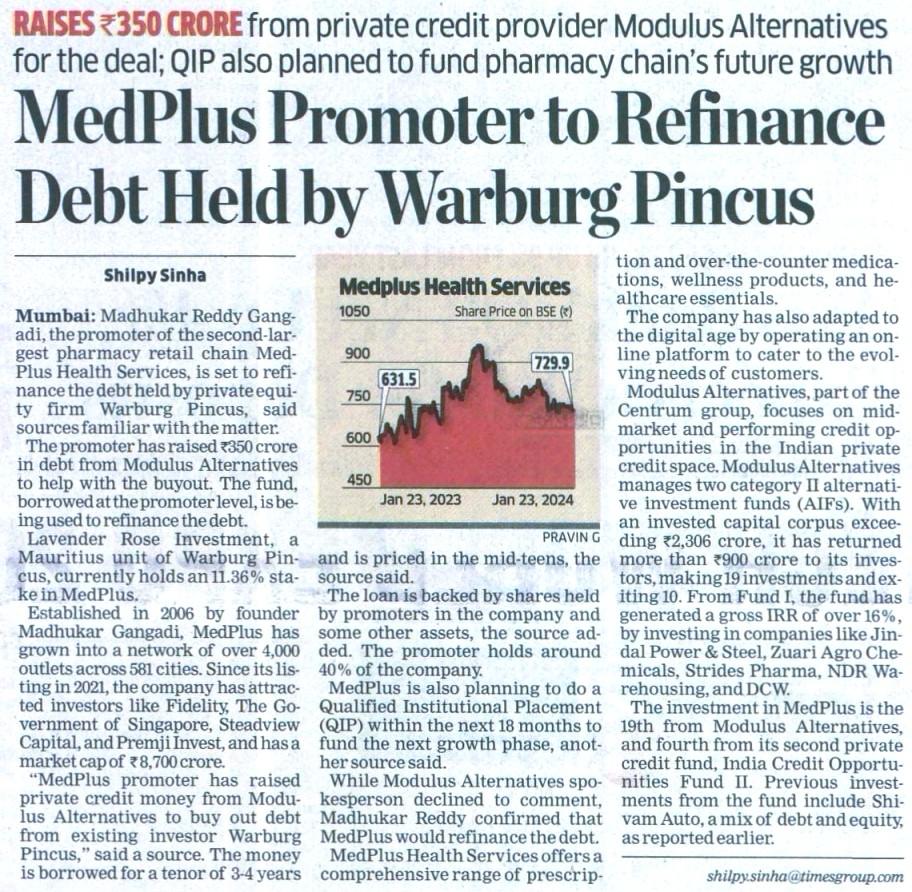

Media Coverage

Centrum’s fund modulus ropes in SBI veterans to drive growth

Private credit must be part of LP portfolios: Panellists at VCCircle LP Summit

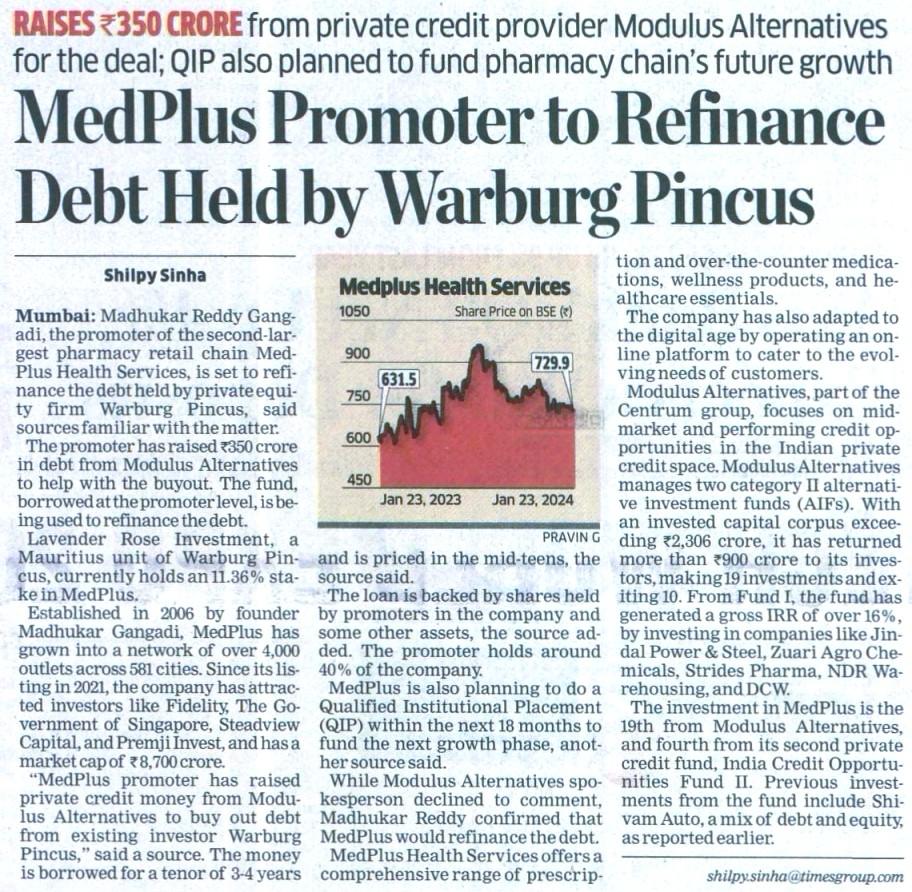

Raises ₹350 crore from Private Credit Provider Modulus Alternatives

Centrum’s fund modulus ropes in SBI veterans to drive growth

Private credit must be part of LP portfolios: Panellists at VCCircle LP Summit

Raises ₹350 crore from Private Credit Provider Modulus Alternatives